As CEO and Founder of data analytics group Datalicious, I was delighted to launch our multi-touch attribution study on the role of Facebook, display and search marketing in Financial Services.

This is the largest study of its kind and it shows how display advertising has come to be undervalued in a last-click attribution model and how actioning multi-touch attribution insights can improve overall return on advertising spend (ROAS).

In the study, we answer the key question all advertisers face – how do we allocate media budgets across channels to maximise overall ROAS with a limited budget?

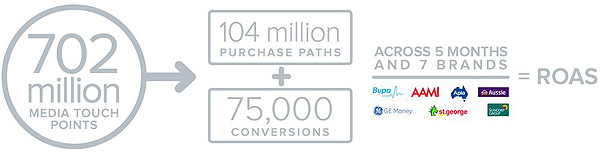

What was analysed?

We analysed 702 million media touch points across 104 million purchase paths and 75 thousand conversions across five months and seven brands – St George, GE Money, Suncorp, AAMI, APIA, BUPA and Aussie – to understand the true impact of digital media channels and the efficiencies to be gained by stepping away from traditional last-click style attribution.

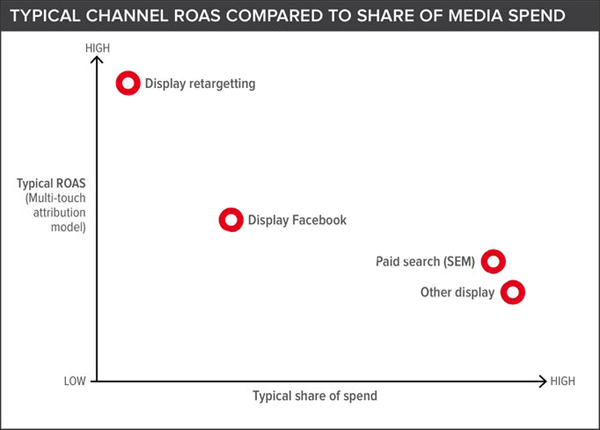

Typical channel ROAS compared to share of media spend

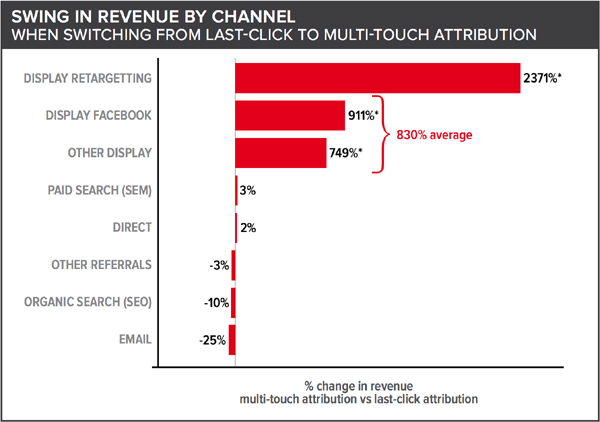

Accurate attribution results from the study demonstrate that display and Facebook ads should be credited for 830% more revenue on average than previously thought.

Swing in revenue by channel

*Note: The percentage increase for display channels is so significant because these channels basically did not receive any credit at all in last-click based attribution model hence the swing compares the new (multi-touch) figures to a very low (last-click) base.

It’s time for marketers to let go of their obsession with search advertising when they allocate their media budgets.

In the end it is about achieving the channel mix, and multi-touch attribution helps to identify the roles that different channels play in the path to purchase.

Even though paid search (SEM) is likely overvalued, that does not mean it should be switched off. It simply means the overall spend is not necessarily justified by the returns so optimisation and creative ways of reducing costs are required to increase ROAS.

What prompts people to buy?

The study shows that a better understanding of what prompts people to buy is vital in driving improved ROAS and can even create a long-term advantage over competitors.

For many brands, taking a better look at their ROAS by embracing a multi-touch attribution method will see a radical shift in the way they spend their money.

The research study was commissioned by Facebook, however all areas of the study were ultimately designed, managed and delivered by Datalicious.

Click the link to download your free copy of Optimising digital marketing spend in Financial Services Study.

A second whitepaper including offline data in the attribution modelling will be released in April 2015.

About Steve Poyser